DENVER-US Attorney offices around the country received visits and petitions today from homeowners and advocates calling for the US Attorney General Eric Holder to “Show us the Money.” Six months ago JPMorgan Chase settled with Holder for $13 billion, $4 billion of which was to be directed as relief to struggling homeowners who had been affected by the banking institution’s “fraudulent” mortgage practices.

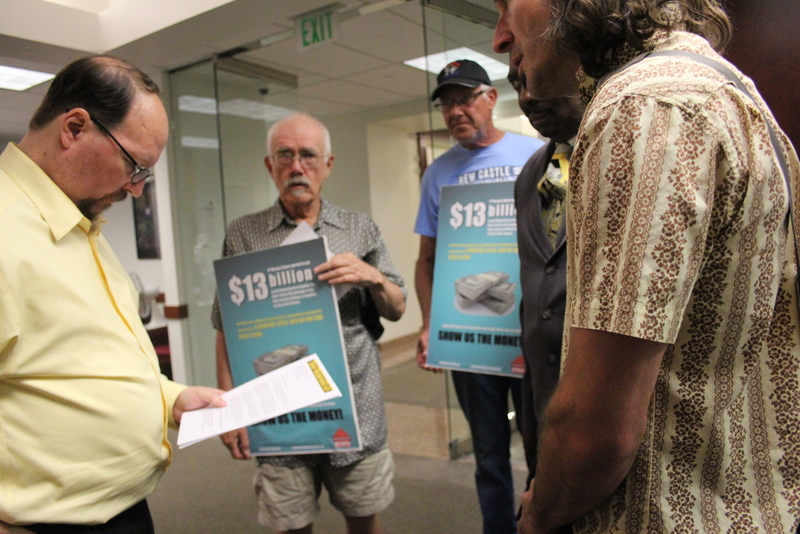

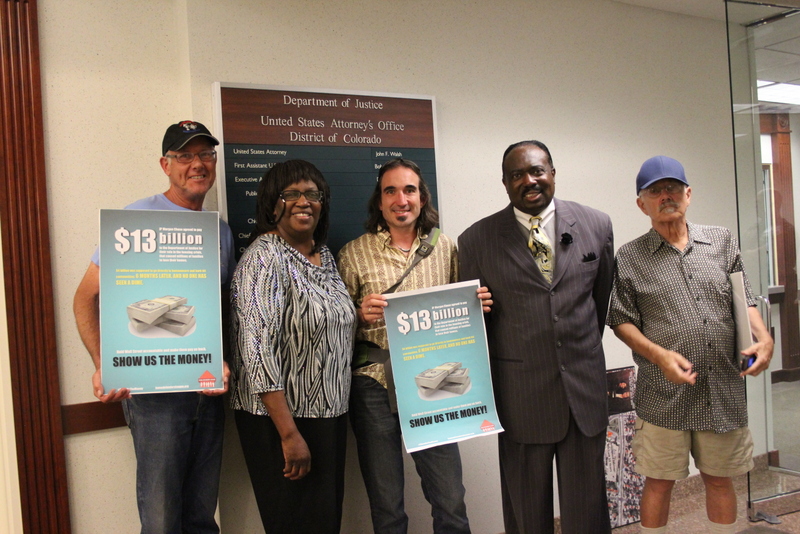

In Denver, groups that advocate for homeowners such as the Colorado Foreclosure Resistance Coalition (CFRC), the Home Defenders League, Move On, and Occupy Our Homes expressed disappointment that homeowners have not seen relief from Chase Bank and that the bank is continuing to foreclose on homes using the same practices that led to the recent settlement according to the homeowner defender groups. Representatives from these groups met with U.S. Department of Justice United States Attorney’s Office spokesman and Public Affairs Officer for the District of Colorado, Jeff Dorschner. Darren O’Connor, who represented the CFRC expressed, “We have yet to see a single dollar spent helping the homeowner. And it’s my understanding we’ve had over 21 of these settlements, many of them in the billion dollar range and we’re not seeing it get to homeowners. So before Bank of America gets to buy their way out of more criminal charges, we want to make sure that there is some structure in place, that the promises made, are the promises kept to homeowners.”

Bank of America is currently negotiating with the Department of Justice in an attempt to settle for the company’s role in the foreclosure crisis. In the Chase settlement however, a condition that the DOJ imposed on the bank included the banking institution’s helping affected families by donating or selling properties at a discount and in addition that the institution would agree to financing new mortgages for homeowners who lost their homes to foreclosure.

In a statement released by the Home Defenders League about today’s national actions, the group expressed, “We need to make sure our voices are heard, and that the relief gets to the people who need it the most.” Fred Hendrich with CFRC continued, “ Some of the other places where there’ll be big actions will be in Atlanta, most of the large cities in California where the Home Defender League also has strong affiliates. The reason that we are doing this is because our only weapon is pressure and the more cities that we can get to pressure their US Attorneys, the more likely we are to get some action.” In May 2013, homeowners and advocates including Henrich staged an action outside the Justice Department as they asked for a meeting with Holder. They sat behind a police barrier and chanted, sang songs, and then blocked traffic in front of the Robert F. Kennedy building. “We tried to get an appointment with Mr. Holder and we got no reply there. So we ended up with 34 people arrested.” Two others arrested were from Denver, one of whom had lost her home in a violent eviction by the Idaho Springs SWAT team. Sahara Donahue is still without permanent housing and is one homeowner who has not seen relief.

Reverend Patrick Demmer who is pastor at the Graham Memorial Community Church of God in Christ accompanied the group because he said that his congregation has been heavily affected, “Minorities, especially African-Americans [are the most affected]. We get the end of this. We feel the blunt of these foreclosures. And a lack of due process and just finding a difficult way in how to get through all the red tape. Then, to see that there are those banks, those other lending institutions that have been found guilty and basically have bought their way out of prosecution. I think that’s wrong. I think that’s a problem.”

Those who took part in Tuesday’s action want the Department of Justice to implement measures that prevent big banks from forming smaller mortgage companies thereby allowing big banks to circumvent responsibility and payouts, “Mr. Dorschner you mentioned some of the banks”, continued O’Connor, “Here in Denver right now Bank of America was on the 5 Big Bank Settlement. What’s happening here is that far too often they are transferring their loans to a new servicer who’s not having to operate under those settlement agreements and it turns out here in Denver, we’re seeing this repeatedly. Homeowners are being transferred to Nation Star Mortgage and when you look at Nation Star, they’re started by Bank of America. So Bank of America has basically started a shell company so they can continue doing all of the things that they’ve been doing. And we’re not getting any relief. So we would love to have that conversation.”

Nation Star’s Chief Executive Officer Jay Bray formerly held executive positions with Bank of America. From 1994-2000, he held leadership roles and managed the Asset Backed Securitization Process for mortgage-related products for the banking institution. He implemented a profitability plan and managed investment banking relationships.

Linda Donna whose mortgage is with Bank of America accompanied the group to Walsh’s office, “ [Bank of America] happens to have all four of my properties and they were mis-posting payments. They were not applying payments. They have my personal property insurance check that they haven’t applied. And that was sent to them in November in 2010. As a result of their misapplication of payments to the various properties, I’ve had to pull three of my properties out of foreclosure, having to pay excess money, having to pay penalties on that money because I had to pull it out of my IRA [retirement] accounts. Currently I filed charges against them after promising me a modification or saying they’re going to modify my loan for so many months. This went on for six months. And then they sold my loan to Nation Star. Nation Star gets it and they have no information. So I’m starting all over.”

In asking for her suggestions to other homeowners under the same circumstances, she advised, “Don’t bank with Bank of America. Join a credit union. Look at your papers, be careful [what] you’re signing, watch everything. Make sure you have tracking of your actual payments and the fact that they’re actually being posted to the proper accounts. Look at all your Deeds of Trust.”

In response to how she would advise a homeowner to do that she responded,

“In my particular case although I had the account numbers actually on the payment, with [my] having 4 different properties-and this isn’t because I’m some kind of real estate mongrel or something like that-with [my] having the number on there [the checks], they would just pull up my name and post it to whatever came up first. Therefore they were mis-posting payments. They were transferring them to the wrong [accounts]. And then it would end up my fault because of their errors. So they would put my properties in foreclosure saying it hadn’t been paid, when actually they had paid it to the wrong one and didn’t transfer it properly. So, here I am having to pay additional foreclosure fees, overpriced attorney fees, etc. because of the errors that Bank of America made.”

Donna is in proceedings currently and has found herself in the position of representing herself in court,

“I’m waiting for the judge right now because I don’t have $20,000 to hire an attorney all due to some other errors that Key Bank made and Key Investment services so I have to act pro se. Well I’m not a pro se attorney. And so therefore they have all their legal jargon that I have to contend with and I’m just fighting for the rights of my home- my 5th and 14th amendment-to have my home and I’m fighting during my retirement years. So here it is. You work all your life to have a home, to be able to enjoy retirement which I haven’t been able to do for the past 5-6 years because of errors that the banks have made. In doing all this Bank of America has actually ruined my credit so I can’t refinance anything to get to a lower rate. So I’m talking about a 9.7% interest rate that Im having to pay as a result of their errors.”

Home defenders though have argued that small penalties relative to banking institution’s profits leaves open the opportunity to continue committing fraud. For that reason, Henrich was not satisfied with financial penalties against the banks and suggested to Dorschner that his office work for stronger penalties, “What we’re really interested in is criminal prosecutions of the upper executives of the big banks and some of the smaller ones too that are coming along.” To which Dorschner responded, “I think that would be a decision made by the Deputy Attorney General or higher would make a decision regarding criminal charges. So that would not be a decision that we would be able to make here.”

After leaving Walsh’s office the group assembled outside of the building to inform passersby of their positions, “Banks have bought their way out of facing criminal charges! Thirteen billion paid out in settlements supposedly paid out by JPMorgan Chase; 4 billion supposed to go to homeowners for direct relief! Not one dollar yet to be seen! That was six months ago and now Attorney Holder is negotiating with Bank of America and we can expect more of the same unless they’re held accountable!”

Refufia Gaintan/The Nation Report